Access the Latin America Market via Mexico

Add Mexico’s operational capabilities in days and expand your business in the region. Open a local presence and your follow global customers into Mexico or develop first a local pipeline before committing to a large operation.

Review market entry options

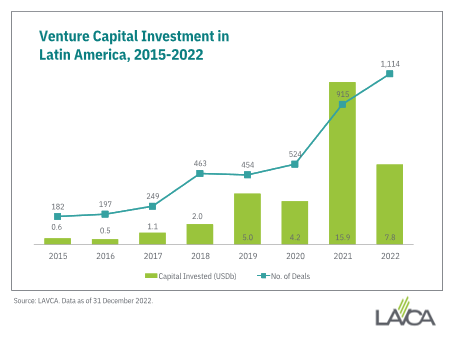

The Latin America Opportunity

How it works

Tech companies can add Mexico’s Operational Capabilities in days to deliver proposals in Mexico, build a pipeline and access a new market. The operation can scale following revenue and not before.

Similar to the successful Shelter Model in the Manufacturing Industry, foreign companies from the IT Industry have the Subsidiary-as-a-Service (SUBaaS) option. This approach avoids unnecessary expenses and risks, while lowering dramatically total costs, opening a legal entity when ready while still maintaining an agile operation.

It resembles the as-a-Service model, as companies pay only for users (workers) they use, benefiting from shared infrastructure. Economies of scale from the vendor further lower costs and provides a faster time to market. Another similarity is starting in weeks and not months, including the option of scaling in size and functionality when needed.

Common Scenarios

- Pipeline Development: Sales Executive with temporary offices for local presence and initial pipeline executive. Adding Marketing Lead (sales collaterals localization), Inside Sales Executive (ISEs), and PreSales roles as it grows. Support for RFP submission and nearshore/local pricing proposals.

- Sales Office: Full Sales Team, with permanent offices and leadership positions. Creation of a Legal Entity for signing local customers. Feedback on quotas, seasonality, and benefits packages according to local market. Mix of permanent/temporary delivery team.

- Region development: A full Sales Team for acquiring initial customers in the region, is needed to develop local resellers/channels. Feedback on companies to Network and Industry/Customers to target. Legal entity and engineering support team for the region.

- Regional Hub: Sales, Delivery, and Support Team for the region, with permanent offices with company brand and legal entity.

All scenarios can scale in size, cities, hiring type, and offices as needed. Including implementing recent grads bootcamps and relocation of foreign personnel.

Because of Everscale industry expertise in the Enterprise Software Ecosystem, the turnkey subsidiary incorporates best practices and built-in capabilities that will assist foreign companies in bypassing the initial learning curve of the local market and enhance the likelihood of success of local strategies.

Customer Examples

Mexico Market Entry

IT Services Company with potential customers in the region, was uncertain of entering the Market due to the associated costs and uncertainties.

To overcome this, utilized Everscale SUBaaS, which allowed them to support their first sales engagements in Mexico while building a local pipeline with a temporary team. Once the pipeline matured, it set up a local entity and grew the team, while still benefiting from an agile operation.

Mexico Market Entry

HCM, RPA and IT Services Provider with presence in multiple countries, provides consulting services with third-party technologies as well as their own.

Challenge: They had global clients that inquired for support in Mexico as well as having few prospects in the country, because of their specialized expertise. However, they were unsure if it was the right moment to enter the Mexico Market due to the associated cost that it typically entails.

Solution

Using a Subsidiary as a Service, the Partner was able to support their first customer engagements while getting the support needed to build a local pipeline. After the pipeline matured, a local entity was set up.

Key takeaways

- Eliminated the setup cost and maintained a small variable team that only grew with their first projects.

- Gained local know-how for hiring the right sales team and compensation packages (quota, seasonality, etc), avoiding a long and costly learning curve.

- It continues to benefit from the economies of scale from the group and uses its legal entity to only sign local customers.

Mexico Market Entry

Global Digital Transformation Company, with offices in APAC, the Middle East, and the Americas.

Their global customers require support in Mexico, so instead of subcontracting local tech companies that could become future competitors, are evaluating expansion options into Latin America.

Choosed the SUBaaS option to avoid setup costs and start supporting their customers locally in weeks, while taking their time in deciding where to open their own branded offices and the right configuration of their team to hire, gradually increasing in size.

Mexico Market Entry

Global Digital Transformation Company, with offices in APAC, the Middle East, and the Americas.

Challenge: They were researching how to open a delivery center in Mexico to support customers in North and South America. The opening of Mexico operations accelerated as global customers are opening opportunities in Mexico- Don’t plan on subcontracting local tech companies that could become future competitors.

Solution

With the help of the SUB.aaS approach, they developed a flexible strategy to grow to a 30-person in less than two years, that could potential save up to 80% on their first year local costs.

Key takeaways

- They received assistance in defining the correct hiring strategy for Mexico City according to the local work culture and a different mix in seniority levels in the talent needed.

- From the start, they were provided with the option to hire recent grads via a Bootcamp and relocate Sr employees from India.

- Developed a cost-saving strategy for facilities & local expenses.

Demand certainty when expanding to a new country

Recommended cities for Nearshore Delivery

With a Population of 130 Million, Mexico has a clear advantage over other LATAM Countries that attract foreign investment, such as Costa Rica (5M) and Panama (4M), with cities larger than other countries.

Review Market Entry Scenarios

Need to answer an RFP or build local presence for a global customer? Schedule a Meeting and learn more on North America Nearshore Scenarios built for B2B Tech Companies.

The SUBaaS framework supports testing the region and customers response before fully committing to a large operation.

The best path possible into Mexico.