In the highly competitive landscape of the tech industry, staying ahead often involves running foreign operations. However, the challenge lies in doing so efficiently, especially when faced with a tight budget for an always changing global economy. In this article, we’ll explore why B2B tech companies in North America have used Mexico’s soft-landing options, such as SUBaaS, to avoid unnecessary costs and risks associated with the Do-It-Yourself approach. This capex-friendly approach is preferred by Private Investors, as they can achieve more with the same budget while owning the operation from day one.

Due to differences in cost of living between countries, hiring an IT professional in Mexico instead of the United States can result in significant savings—typically around 50% to 60%. This cost advantage is even more pronounced at both the junior and senior ends of the experience spectrum.

Adding Mexico’s operational capabilities to the organization adds access to another Talent Pool for North America and access to the Latin American Market. Because of its lower cost of living, it provides cost-efficient operations in North America. Therefore, the challenge lies in determining the optimal approach to establishing operations in Mexico that minimizes the impact on these potential savings while harnessing other strategic advantages.

The comparison will focus on differences between a company starting and running Mexico operations on their own, versus using the assistance of a soft-landing option. The comparisons will focus on 3 areas: Operation Costs, Risk Management, and Time to Market. The soft-landing option for the IT Industry is known as Subsidiary-as-a-Service (SUBaaS), which is the equivalent of the successful Shelter model used by the Manufacturing Industry for the past 30 years. The SUBaaS follows the pay per use model that Tech Companies know well, scaling at their own pace, minimizing costs and risks by leveraging the economies of scale and expertise of the vendor.d.

1. OPERATION COSTS

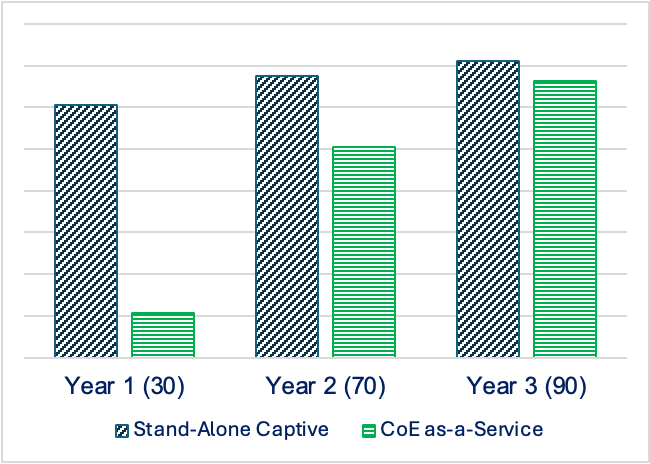

Using SUBaaS versus DIY has a direct impact on costs, with the highest differential in the first twelve months, as the DIY has to set up capabilities that require time and resources that will not be maximized until later, when they reach a cost-efficient threshold to offset setup and ongoing operational expenses. The SUBaaS approach follows the as-a-service model, so companies pay only for what they use, benefiting from a shared infrastructure (think AWS). It can start in weeks instead of months, ready to scale in size and functionality when needed, and not before (like Salesforce).

To illustrate the cost differences between DIY and SUBaaS, consider the scenario of a tech company opening a nearshore delivery office that will grow to 90 people over three years. We include setup costs, operating expenses, and administrative staff. Salaries and rent for the engineering team are excluded since they would be the same in both scenarios. This approach isolates the differences in setup and operational support costs between the stand-alone (DIY) approach and the SUBaaS framework.

Scenario A: Over three years, the foreign company using SUBaaS saves $730,500 USD, representing almost 40% in savings.

This is a conservative comparison, but in reality, the gap will be even larger for two main reasons:

1. For simplicity, the scenario assumes that the DIY approach succeeds on the first attempt every time. In practice, a new company entering a foreign market will go through a trial-and-error process due to the natural local learning curve. Factoring this in further increases the cost gap.

2. A local vendor’s economies of scale can yield additional savings, such as volume-based purchasing power. This can reduce expenses on office leases, hardware, private medical insurance, and more—expenses that quickly add up.

Scale of Operations

As mentioned earlier, for a new foreign operation to be profitable, it must reach a certain size to offset setup and ongoing support costs. The smaller the scale, the more expensive a stand-alone operation becomes. For example:

Scenario B: If the planned operation is a 45-person nearshore office over a three-year period, the cost gap between the DIY approach and the SUBaaS model widens significantly. Using SUBaaS becomes a clear choice, enabling the foreign company to save nearly 60% over three years—equivalent to $1,048,700 USD in savings.

Scenario C: If the operation involves only a 20-person office, the stand-alone approach becomes prohibitively expensive. In this case, SUBaaS delivers savings of over 70% compared to DIY.

2. RISK AVOIDANCE

Countries known for their expertise in attracting foreign investment offer soft landing options that not only deliver cost-saving advantages but also protect (“shelter”) foreign companies from local risks while still running their operations. Although risk cannot be completely 100% eliminated, it can be decreased greatly versus the DIY approach.

This difference can be measured in terms of economic impact across three areas:

2.1 Reduced Exposure to Local Liabilities

Estimate potential fines in Mexico for issues such as misclassification in hiring, tax penalties, and even potential criminal prosecution for improper vendor hiring. Under the SUBaaS model, these liabilities are transferred to the vendor.

2.2 Savings in Advisory/Consulting Fees

DIY operations often require paying for advisory and consulting services in labor law, legal compliance, tax, relocation, and market research. SUBaaS providers handle most of these functions, significantly reducing such costs.

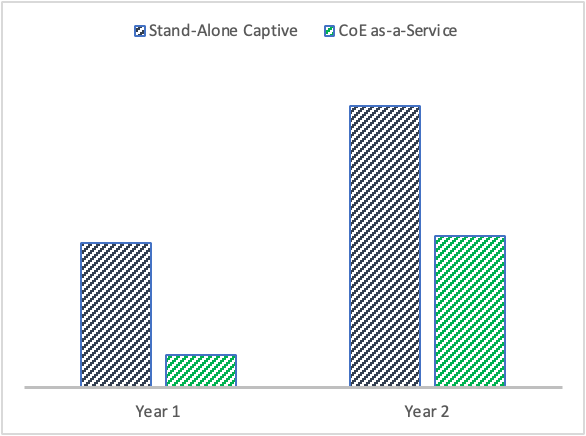

2.3 Lower Shutdown Costs

If there’s a sudden unplanned circumstance that the company needs to terminate operations in Mexico, opting for SUBaaS significantly diminishes shutdown costs compared to the DIY approach.

Using the scenario A, of a new 90 people nearshore operation, the overall shutdown cost impact is reduced by 80%. If it’s at the end of the 2nd year, the cost impact will still be reduced by 35%..

Total Shutdown Costs and Expenses Spent by Year

3. TIME TO MARKET / OPPORTUNITY COST

Estimating the opportunity cost or quantifying the amount of missed revenue in US Dollars due to a delayed time to market can be challenging, as it involves a rough estimate. However, the calculation can be straightforward: it entails calculating the number of months during which the company lacked the resources necessary to deliver the services (either externally or internally) to generate income or company value (whether for the company itself or for its customers).

As noted earlier, one of the main advantages of the as-a-service model is the speed at which operations can be made ready to use. The saved time can be calculated as follows:

- Startup Timeline: Launching a new operation in Mexico—including local incorporation, bank account setup, and hiring the first administrative employee—typically requires about four months. This period can be longer depending on appointment availability with local authorities and the timing of the first hire. In contrast, the SUBaaS approach takes about two weeks.

- Industry-Specific Expertise: Working with a SUBaaS vendor specializing in your industry not only saves time but also shortens the local learning curve for establishing a new business practice. For example, Everscale Group, which focuses on the Enterprise Software Ecosystem, provides access to a pre-vetted talent pool of experienced bilingual IT professionals. There’s also no need to start from scratch with local universities for recent graduate hiring, thanks to an established Recent Grad Boot Camp program. For a Sales Office setup, a curated list of recommended sales executives is provided, along with assistance in defining local quotas. For a PMO Practice, specialized talent is already identified for tasks such as LATAM Rollout/Localization Projects, AMS, and Presales. This expertise can save an additional 1 to 3 months in achieving full functionality compared to the DIY approach.

In summary, SUBaaS significantly shortens the implementation timeline from project approval to full operational capability for new business practices. For operations involving multiple capability or practice additions, the time gap between SUBaaS and DIY becomes even greater.

A company planning to establish a 50-person nearshore support team could reduce startup time by four months with SUBaaS, plus save an additional two months in building the business practice compared to a stand-alone approach in a foreign country—resulting in up to six months of time-to-value gained. If this service were billable to customers, the opportunity cost would be the revenue lost over that half-year delay.

In Conclusion

For tech companies navigating the complexities of foreign operations with a tight budget, the Subsidiary-as-a-Service option emerges as a strategic enabler. Despite its evident benefits as a financial strategy, its primary advantage lies in its flexibility. During the planning phase, companies outline a proposed operation size and hiring plan, but when reality intersects with the business plan, adjustments are often necessary.

The SUBaaS model provides the essential capability to scale and adapt without incurring additional costs and risks, making it the ideal fit for uncertain economic conditions. This type of approach makes it ideal for a scalable and cost-efficient way to test digital initiatives, according to ISG. It enables critical elements of innovation: agility, scalability, cost-efficiency, and versatility.