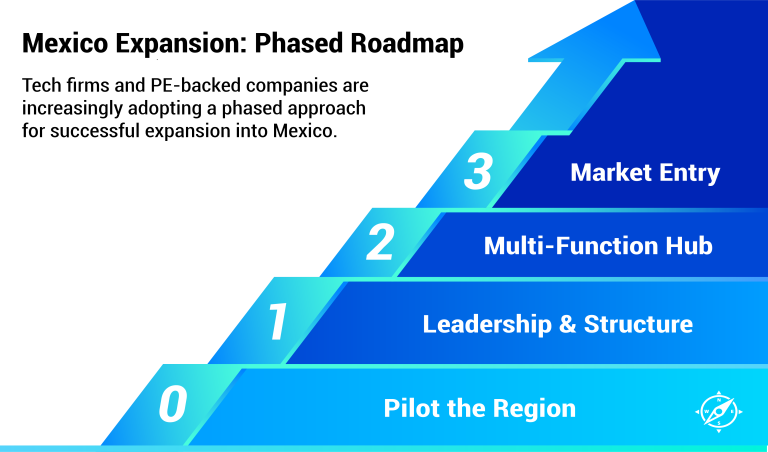

This article explores how tech firms and investors are expanding to Mexico using a phased approach. By leveraging flexible frameworks, companies can test the market, establish a solid foundation, expand capabilities, and drive regional growth—minimizing risks and total costs.

Private equity firms must deliver a significant return to their investors over a specific period, ensuring that the value of the company they acquire increases.

One might assume they immediately start adding new structures and capabilities to drive rapid growth, but that’s not true. On the contrary, most gradually build layer by layer to ensure success while mitigating unnecessary risks, which can be just as important.

Unknowingly, tech companies are increasingly adopting a similar strategy when opening a nearshore location.

Instead of immediately building a multi-capability operation with a large workforce to support future growth, they are taking a methodical approach. This enables them to validate assumptions and adjust accordingly at each phase, avoiding overspending.

Because Mexico is the undisputed nearshore location for North America, many companies have opened operations in the country, creating numerous success stories and some failures. This has generated enough data to identify a common phase-by-phase roadmap that maximizes the chances of success for those considering expansion.

Operating partners have now incorporated this approach in their playbooks, including cost estimates, timelines, and available frameworks to enable expansion in Mexico (nearshore), not just India (offshore).

Following real cases of enterprise software companies, system integrators, and professional services firms, we identify three phases, including an optional Phase Zero. Remember that some companies might have tighter timelines, leading them to jump directly into phase two or three, while others may stay in phase one, as it is more convenient to their organization plans.

Companies must learn how to benefit from the country’s soft-landing options and engage the right local advisors to help validate their plans to gain this flexibility. So, what are these steps?

An optional phase that some small and medium-sized businesses and risk-averse companies adopt involves setting up a temporary operation to test the region. Available frameworks enable foreign companies to evaluate their regional assumptions and the local talent pool by hiring a temporary team managed by their headquarters. System integrators frequently use this approach, as their global customers often need to implement solutions in their foreign subsidiaries, too, requiring a temporary team in a new country for the project’s duration.

The Subsidiary-as-a-Service (SUBaaS) model, also known as GCC-as-a-Service, can facilitate this setup. This approach avoids early commitments to a region while retaining ownership. It provides additional insights to fine-tune the expansion plan and allows the company to permanently hire the talent after the project ends.

However, it is important to note that even a small team still requires administrative support across various functions to operate locally.

A common characteristic of this phase is that the temporary team consists of senior professionals who require minimal supervision and work remotely from home or a part-time co-working space. The company monitors productivity and skill levels to determine location success and cultural fit, refining hiring strategies accordingly.

Software companies usually skip this preliminary step. As they have a temporary contract, they risk losing trained talent to more appealing permanent opportunities. So, when they use this approach, they quickly move to phase one once their assumptions are validated.

Once the temporary team proves successful, or when a software company is ready to launch operations in Mexico, a location is selected, and an initial small team is established with employment benefits comparable to those at headquarters. An office is set up to establish a local presence.

As private equity firms prioritize laying a solid foundation, foreign companies must first create the right flexible structure and secure strong leadership for future growth. Typically, the initial operation is small and focuses on a single business practice before growing its size.

An incubation or break-even period will occur before the organization starts delivering results. It is essential to estimate setup costs and operational expenses incurred during this period. A soft-landing approach can significantly reduce the local learning curve and initial investment, shortening the time-to-value period.

During this phase, the organization grows its team, develops local business processes, and establishes a local presence.

The team hired at this stage shapes company culture and how the brand is perceived locally, which will play a key role in future hiring needs. This phase enables critical elements of innovation: agility, scalability, and cost-efficiency. Conversely, if an innovation does not meet expectations, the business can quickly pivot or dissolve the operation to minimize losses.

At the end of this phase, the company will have gained insights into local structures and risks, allowing it to decide whether to continue with the SUBaaS model or transition to a wholly owned subsidiary. The current trend shows that companies are increasingly seeking assistance from local specialists, rising from 30% to 45-50% over the past four years, driven by the adoption of newer frameworks that gained traction during the pandemic.

Companies can broaden their team beyond a single business practice with a solid foundation. The Mexico office transitions into a multi-functional hub supporting other business areas, including administrative functions such as collections, accounting, and billing. This leverages Mexico’s cost efficiencies, which are fundamental for private equity portfolio companies.

Initially, the average operation size was below 100 employees, a structure also known as a Micro Capability Center. According to ISG, this approach is “a cost-effective, capex-friendly solution for companies exploring new digital initiatives by allowing them to test the feasibility and determine true value potential”.

Not all companies move into this phase; instead, they maintain their Mexico office as a nearshore center. However, for those who do, this phase marks the evolution of the office into a revenue-generating center by targeting customers in the new region.

For operating partners, entering a new market is crucial to keep increasing the company value. This can also be achieved through a merger and acquisition strategy, though it requires a significantly higher investment.

When entering the Latin American market, companies choose between the two largest economies: Mexico and Brazil. However, Mexico is preferred for expansion into other Spanish-speaking countries, as Brazil speaks Portuguese, and software products require significant localization, making it a standalone market.

Mexico is also recognized as the proving ground and starting point for Latin American tech startups, serving as a launching pad for other Spanish-speaking countries.

This phase marks the transition from only supporting North America to becoming a market-facing entity. The company establishes a local go-to-market strategy, hires sales leadership and executives, and invests in marketing campaigns. It builds brand awareness by attending industry events and forming strategic partnerships. Software companies often engage local resellers to develop sales channels.

Not all soft-landing providers can support foreign companies at this stage. So, if this step is in future plans, no matter how far, plan accordingly with the right framework and vendor to support it.

A company’s expansion into a new country should be an incremental, well-planned process. By following a phased approach—testing assumptions, establishing a strong foundation, adjusting and scaling operations, transitioning to a multi-functional office, and ultimately driving regional growth—businesses can mitigate risks and optimize their chances for success.

With today’s flexible soft-landing frameworks, there is no longer a need to commit early to a large-scale operation in an unknown region. This methodical approach aligns with a private equity firm’s roadmap, prioritizing creating a cost-efficient structure first, then making significant investments and adding capabilities before pursuing growth in new markets.

The SUBaaS model is similar to AWS’s pay-per-use approach. Instead of building a data center for a new company, customers benefit from economies of scale, scaling in size and functionality as needed. In addition to reducing costs and accelerating time to value, specialized SUBaaS vendors provide valuable research and expertise at each step, shortening the learning curve and minimizing unplanned expenses. This is why it is crucial to evaluate vendors based on their end-to-end expertise and ability to scale alongside their customers, ensuring they have the necessary infrastructure to support long-term growth.

Ultimately, investors and business owners share the same goal: increasing the success rate of an expansion plan in an unfamiliar region to enhance company value—whether by adding new capabilities, entering a new market, or both. Following a phased roadmap provides certainty and much-needed flexibility, enabling companies to adapt to the ever-changing global economic landscape.