For years, tech companies expanding offshore that were looking for the advisory of a local expert, favored the Build‑Operate‑Transfer (BOT) model to launch Global Capability Centers (GCCs) or Shared Services Centers. The specialized vendor built the operation from scratch—dedicated infrastructure, a new legal entity, admin staff hiring, policies—then stabilized it and transferred it to the client after a set term. Because the vendor assumes execution risk, BOT pricing typically includes a margin on top of the total operation (a % uplift). It’s more expensive than the Do-It-Yourself approach, but the premium is often justified: it reduces unknown‑country risk and limits budget overruns with a turnkey, governed path to transfer.

What’s changed

An evolution of expansion models—the As‑a‑Service framework (Subsidiary‑as‑a‑Service / GCC‑as‑a‑Service)—has gained momentum. It borrows the pay‑per‑use logic from the cloud, and it’s not just for offshore builds; it has quickly become the default for nearshore launches, which often start smaller and prioritize flexibility and agility.

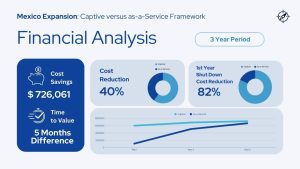

With As‑a‑Service, there’s no % uplift on total spend. Historically, companies in BOT tried to fast‑forward to the transfer milestone to eliminate the uplift. In contrast, As‑a‑Service leverages the partner’s economies of scale, often yielding lower startup costs and lower run‑rate Opex than a do‑it‑yourself captive at small/mid scale. As a result, many clients choose to stay longer with the As‑a‑Service model—maximizing savings—much like a startup using AWS instead of building a data center: pay only for what you use.

Captive (DIY): The baseline comparison

A traditional captive is the default end‑state many companies consider before engaging a specialized vendor. Regulations and operational dependencies make the rollout sequential: entity setup, accounting, payroll, banking, and legal compliance before it can start recruiting to scale. Captives typically need to reach a headcount threshold to offset setup/ongoing support costs. Waiting four to five months before hiring the first employees extends the time to break‑even.

How As‑a‑Service changes the timeline

As‑a‑Service uniquely accelerates time‑to‑value. You plug into a partner’s ready‑made operational platform—HR, payroll, compliance, facilities, recruiting, procurement, local communities, and networks. It’s the AWS analogy applied to global expansion: pay‑per‑use, then pivot and scale at your pace until you reach the cost‑efficiency for a stand‑alone operation. Teams are productive and culturally integrated from day one. Companies can often hire their first employee in ~2 weeks and, crucially, be cost‑efficient from the start.

BOT vs As‑a‑Service — What to keep in mind

BOT Model

- Vendor builds and operates for a set period; transfer completes the journey.

- Risk transfer and budget discipline during build/stabilize.

- Cost premium via % uplift during the operate phase.

- Best for large, permanent builds when the company leadership lacks prior experience establishing a foreign Global Capability Center.

As‑a‑Service Framework

- Pay‑per‑use with no % uplift; leverage economies of scale.

- Lower startup and operating costs than DIY captive.

- Speed: first hires in weeks, not months.

- Flexibility: Validate assumptions, pivot roles/functions/locations.

- Many companies stay longer on this model to maximize savings; convert to a captive only when scale justifies it.

Captive (DIY) — reference baseline

- Sequential setup (entity, banking, payroll, compliance) means a slow ramp.

- Needs scale to reach efficient unit economics.

Key questions:

- How fast must we show value?

- How much budget can the company invest?

- How certain is our scale and scope?

- How ready are we to commit to the new country?

In Conclusion

For most modern expansions—especially nearshore or function‑by‑function growth—As‑a‑Service delivers speed, flexibility, and cost efficiency without sacrificing cultural ownership. BOT remains a strong path when you need a turnkey large build and will pay a premium for risk transfer and a defined hand‑off. Treat Captive as your baseline reference and potential end‑state once scale and internal capabilities make it efficient.